Decoding Bitcoin's Destiny: Halving Forecasts and Current Trends

2024-06-21 01:17:36

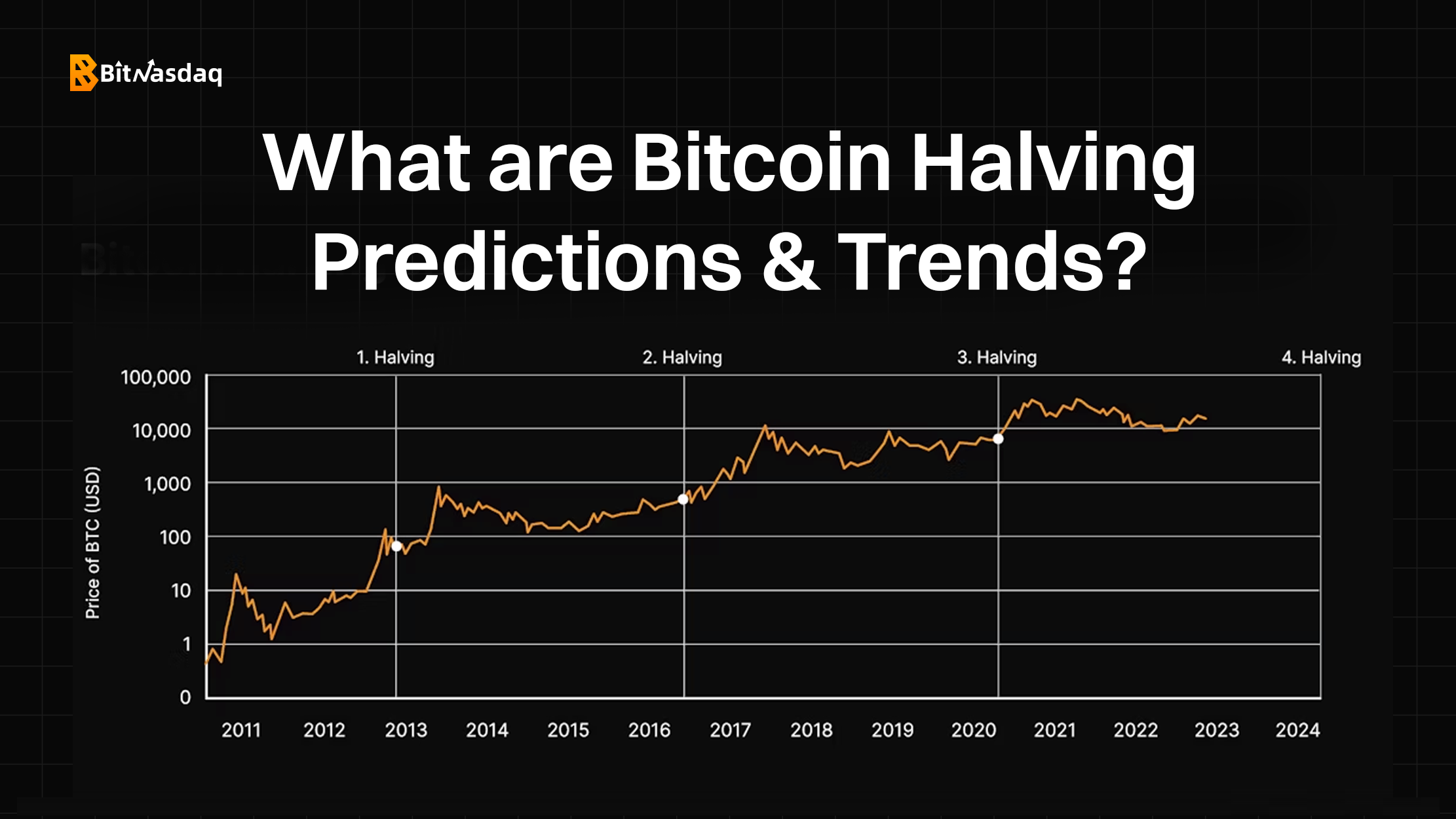

Bitcoin halving , a pivotal event occurring approximately every four years, is embedded in the cryptocurrency's fundamental structure. This process involves an intentional reduction in mining rewards, halving the rate at which new bitcoins are generated. The impact of these halving events extends beyond immediate market dynamics, shaping trends and predictions that guide the strategies of investors and enthusiasts alike.

What are Bitcoin Halving Predictions and Trends

As the crypto community eagerly awaits the next Bitcoin halving, the air is filled with predictions and trends shaping the future of this digital currency. While the crypto market is inherently unpredictable, historical patterns and current indicators provide insights into potential outcomes.

Price Volatility

One recurring trend around Bitcoin halving is increased price volatility. The anticipation leading up to the event and reactions post-halving often result in notable price fluctuations. Traders and investors should brace for a period of heightened market activity. Price speculation around Bitcoin halving revolves around the reduction in new supply, creating scarcity and potentially driving up demand.

Altcoin Reactions

The interconnected nature of the cryptocurrency ecosystem means that events affecting Bitcoin can influence other digital assets. Analysts are carefully observing how altcoins will react to Bitcoin halving, considering potential shifts in their valuations and market behavior.

Institutional Interest

As Bitcoin gains wider institutional acceptance, analysts predict increased interest and participation from institutional investors around halving events. This institutional involvement could contribute to a more mature and stable market.

Technological Developments

Bitcoin halving events often coincide with advancements in blockchain technology and improvements in the overall crypto infrastructure. Predictions include announcements of technological developments and innovations that could shape the future of the industry.

Long-Term Market Trends

While short-term predictions are common, analysts are also examining the potential long-term effects of Bitcoin halving. This includes its impact on Bitcoin's role as a store of value, its integration into traditional financial systems, and its overall course in the evolving global financial landscape.

As we approach the next halving, market participants must remain vigilant, staying informed about evolving dynamics. Whether it's anticipating price movements, assessing the reactions of altcoins, or considering the implications for miners, a well-rounded perspective is key. As with any investment, risks and opportunities coexist, making informed decisions essential for success in the dynamic world of cryptocurrency.

Bitcoin Halving Predictions of 2024

Predictions for Bitcoin's performance in 2024 have sparked considerable interest within the cryptocurrency community. There are several expert forecasts for Bitcoin Halving, Standard Chartered, initially projecting a $100,000 value by year-end, recently updated its forecast to a more optimistic $120,000. The revision is tied to the increased profitability per Bitcoin mined, potentially leading miners to sell fewer holdings, thereby reducing overall market supply. Bernstein Research presents a bullish course, foreseeing a potential surge to $80,000 by the close of 2024 and a further climb to $150,000 by 2025. Their analysis places emphasis on the anticipated mainstream institutional adoption of Bitcoin as a key driver for this upward trajectory. BitQuant's analysis, grounded in Elliott Wave charting and historical behavior, sets an ambitious target of around $250,000 for Bitcoin. Anticipating a surpassing of the previous all-time high before the halving, BitQuant acknowledges expected fluctuations and pullbacks along the way. And Bloomberg's outlook adds to the optimism, with analysts suggesting that Bitcoin might surge to as high as $500,000. This positive sentiment is fueled by Bitcoin's consistent climb toward new yearly highs and recent developments, including the approval of spot Bitcoin ETFs.

The diverse range of predictions surrounding Bitcoin's future price as the April 2024 halving approaches highlight the uncertainty within the cryptocurrency market. While historical trends provide some guidance, the unpredictable nature of the market calls for a cautious and informed approach. Investors and enthusiasts should remain vigilant, staying informed about market dynamics, regulatory changes, and technological advancements to navigate the dynamic landscape of Bitcoin and cryptocurrencies.

Trends in BTC Bitcoin Halving Cycles

By being informed about the trends in BTC Bitcoin Halving Cycles, it gets easy for the user to predict and adjust their strategies;

Historical Patterns

Bitcoin halving cycles have established visible patterns through historical observations. Typically occurring every four years, these cycles bring about a reduction in block rewards, influencing the rate of new Bitcoin issuance. The anticipation leading up to each halving event has triggered heightened market attention, characterized by increased trading volumes and notable price movements.

Mining Optimization

Miners play a pivotal role in the Bitcoin ecosystem, and their behavior leading up to halving events is noteworthy. As the reward diminishes, miners often seek ways to optimize operations, invest in more efficient hardware, or assess the overall profitability of their activities. These strategic moves contribute to fluctuations in hash rate and may impact transaction speeds and network security.

These trends leading up to Bitcoin Halving are important as they lead the users to the path of success.

Bitcoin Halving Predictions

Market Sentiment Impact

Bitcoin halving predictions carry substantial weight in shaping market sentiment. Analysts and enthusiasts put forth a range of forecasts, ranging from conservative estimates to more ambitious figures. The diversity in predictions creates an atmosphere of speculation, influencing investor decisions and contributing to the overall dynamics of the cryptocurrency market.

Scarcity Dynamics

One general theme in predictions is the concept of scarcity. The reduction in the rate of new bitcoin issuance is seen as a catalyst for scarcity, potentially driving up demand and, subsequently, prices. This scarcity dynamics theory supports many predictions and is a central element in the broader narrative surrounding Bitcoin halving events.

Institutional Perspectives

Expert forecasts often consider institutional perspectives, taking into account factors like institutional adoption, macroeconomic trends, and regulatory developments. These forecasts become influential as institutional involvement in the cryptocurrency space continues to grow. The alignment of expert opinions with institutional strategies adds a layer of complexity to the overall prediction landscape.

Balancing Optimism and Caution

Navigating the diverse predictions requires a delicate balance of optimism and caution. While historical trends provide insights, the unpredictable nature of the cryptocurrency market demands a measured approach. Investors and enthusiasts are encouraged to stay informed about market dynamics, regulatory changes, and technological advancements to make well-informed decisions in the lead-up to Bitcoin halving events.

The trends in BTC Bitcoin halving cycles unfold through historical patterns and mining optimization, while predictions impact market sentiment, emphasizing scarcity dynamics and incorporating institutional perspectives. Navigating these elements requires a nuanced approach, acknowledging the complexity of the cryptocurrency landscape.

In Conclusion

Bitcoin's halving, occurring every four years, shapes the cryptocurrency landscape, influencing trends and predictions. As the community awaits the next halving, increased price volatility, altcoin reactions, growing institutional interest, technological advancements, and long-term market trends emerge. Predictions for 2024 showcase diverse outlooks: Standard Chartered's optimism at $120,000, Bernstein Research's climb to $150,000, BitQuant's ambitious $250,000 target, and Bloomberg's optimism of $500,000. Historical patterns in halving cycles reveal market attention triggers, and predictions impact sentiment, emphasizing scarcity dynamics and institutional perspectives. Navigating this landscape requires a nuanced balance of optimism and caution for informed decisions.

Share

Share

Like

Like

Dislike

Dislike