Strategic Insights: Unveiling Bitcoin Halving In the Mining Sector

2024-06-21 01:16:36

Bitcoin halving is a fundamental aspect of Bitcoin's design, it occurs approximately every four years and involves a 50% reduction in the reward miners receive for validating transactions. This intentional undersupplying or scarcity is done to manage the total supply of Bitcoin, which further influences the market dynamics and sparks increased interest and Price speculation around Bitcoin halving. This halving of Bitcoin results in increased volatility and significant price movements.

On the other hand, the mining sector plays a vital role in functioning blockchain networks like Bitcoin. Miners utilize powerful computers to solve complex mathematical puzzles, validate transactions, and secure the network. The mining industry is dynamic, with constant innovations in the hardware and strategies to maintain profitability, specially in the face of halving events.

These two facets of the cryptocurrency ecosystem; the Bitcoin Halving and Mining Industry, are closely connected. Bitcoin halving directly impacts miners by reducing their rewards, prompting them to adapt, innovate, and find new ways to keep going. The mining industry's response to halving events, in turn, influences the overall health and security of the Bitcoin network. The delicate balance between the market and mining adapting keeps shaping how people see Bitcoin and contributes to the evolving narrative of Bitcoin and its ecosystem.

What Is Bitcoin Halving's Impact on Miners

Reduced Rewards

This is the most immediate impact of Halving on miners. The reduction in the number of newly produced bitcoins miners receive as a reward for their mining efforts impacts miners a lot by affecting the Profitability of mining after halving. This shift challenges the profitability of mining operations, specially for miners who rely heavily on the reward component of their income.

Challenges To Profitability

With a diminished reward, miners face increased operational costs, including electricity and maintenance expenses. The reduced Bitcoin halving mining profitability often prompts miners to reassess their strategies, upgrade their hardware, or explore more energy-efficient mining practices.

Technological Innovation

Bitcoin halving events stimulate technological innovation in the mining sector. Miners respond to the reduced rewards by seeking more efficient and powerful hardware, optimizing their operations to maintain competitiveness in the network, and adapting to the evolving landscape.

Market Dynamics

The aftermath of halving events contributes to increased market volatility. Traders and miners both closely monitor these periods for potential price fluctuations and adjust their strategies accordingly.

Hash Rate Fluctuations

The hash rate, representing the computational power dedicated to the Bitcoin network, often experiences fluctuations around halving events. Miners may adjust their activities, leading to temporary changes in the network's overall security and transaction processing speed.

In short, the impact of halving on miners is multifaceted, ranging from immediate reductions in rewards to long-term shifts in mining strategies and technological advancements. As in the Bitcoin Halving and Mining Industry, miners adapt to these changes, they play a crucial role in maintaining the stability and security of the Bitcoin network.

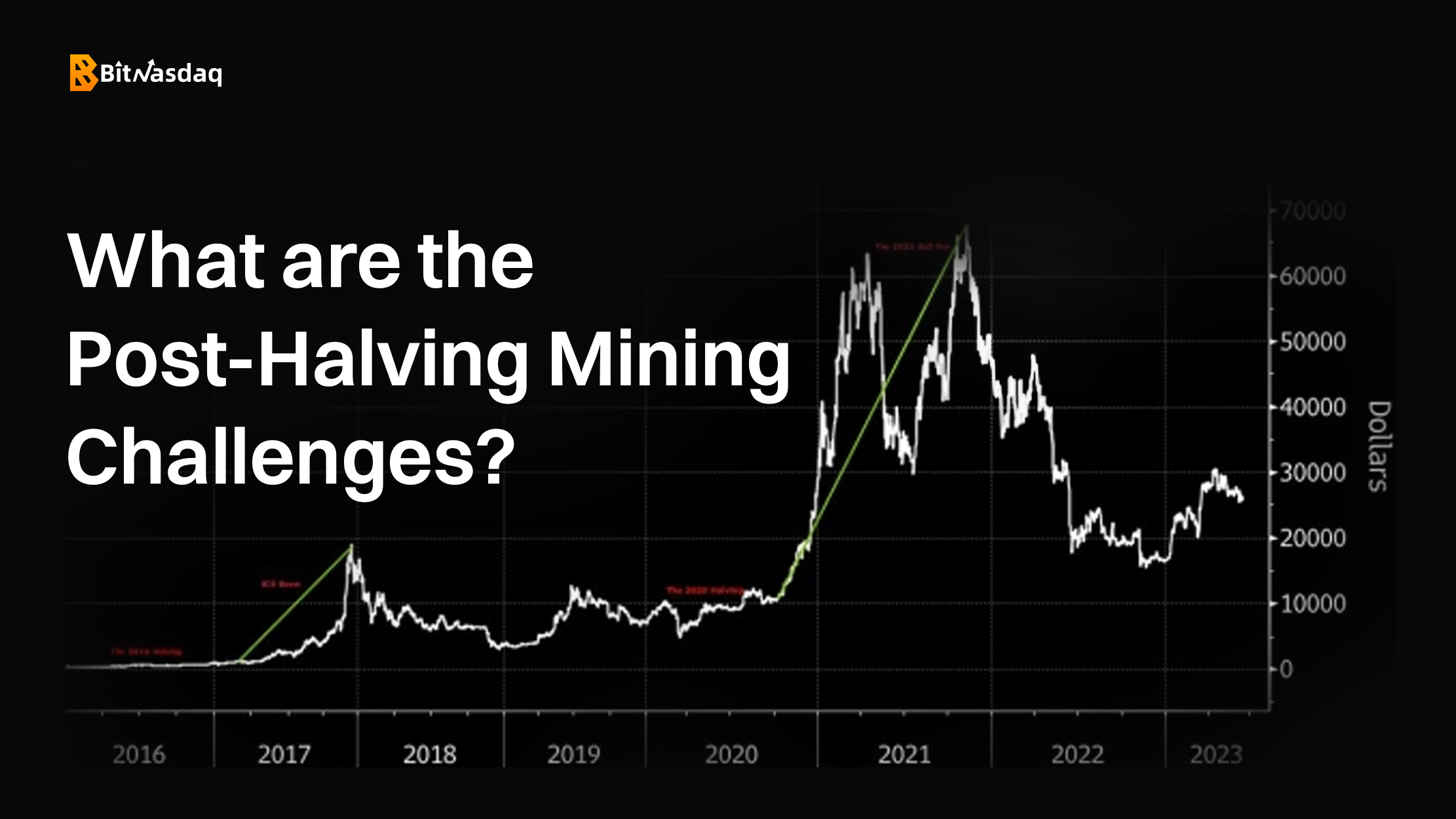

What Are The Post-Halving Mining Challenges

Reduced Rewards And Profitability

The most immediate challenge is the reduction in mining rewards resulting from adjustments in mining difficulty, which directly impacts the profitability of mining operations. Miners must contend with earning fewer bitcoins for the same computational effort, leading to increased operational costs, specially in electricity-intensive mining.

Adjustments In Mining Difficulty

Bitcoin's algorithm automatically adjusts the mining difficulty approximately every two weeks to maintain a consistent block production time. Post-halving, the reduced rewards may trigger adjustments in mining difficulty, impacting the competitiveness and efficiency of mining operations.

Increased Competition

The competition among miners intensifies when the block reward decreases. More miners may join the network, attracted by the potential for higher bitcoin prices. This heightened competition can pose challenges for smaller miners with limited resources.

Technological Upgrades

Miners face the ongoing challenge of staying competitive by investing in the latest and most efficient mining hardware. There is often a surge in technological upgrades as miners seek to optimize their operations and maintain profitability.

Market Volatility

Bitcoin mining post-halving periods are characterized by increased market volatility. Miners, who may hold a significant portion of their earnings in Bitcoin, must navigate price fluctuations, potentially impacting their revenue and overall financial stability.

Evolving Regulatory Landscape

The regulatory environment surrounding cryptocurrency, including mining activities, is continually evolving. Miners must stay informed about regulatory changes that could impact their operations.

Environmental Concerns

Bitcoin mining has raised environmental concerns due to the energy consumption related to it. Post-halving, miners may face increased scrutiny and pressure to adopt more sustainable and eco-friendly mining practices.

Navigating these post-halving challenges requires adaptability, strategic planning, and a commitment to staying alongside of technological and regulatory developments.

What Can Be The Possible Solutions To These Challenges

Addressing the challenges that arise in Bitcoin mining after halving is a complex task that demands a comprehensive strategy. One key aspect involves miners focusing on enhancing their operational efficiency through technological upgrades. Investing in cutting-edge mining hardware enables miners to maintain competitiveness, optimize energy consumption, and maximize profitability despite reduced rewards.

Diversifying revenue streams is another crucial element for miners to counter market volatility. Exploring additional sources of income, such as cryptocurrency trading, offering mining-related services, or participating in decentralized finance (DeFi) projects, can provide a buffer against the impact of decreased mining rewards.

Moreover, Collaboration and resource pooling become essential, particularly for smaller miners facing intensified competition. Joining mining pools allows miners to combine their computational power, increasing the likelihood of successfully mining blocks and receiving rewards. This collaborative approach fosters inclusivity and aids smaller miners in navigating heightened competition.

Environmental sustainability is an increasingly important consideration. Miners can address this by embracing eco-friendly practices, such as using renewable energy sources, adopting energy-efficient hardware, and participating in initiatives promoting environmentally conscious mining. This not only contributes to a greener image but also aligns with global efforts towards sustainable practices.

Additionally, Ensuring regulatory compliance is vital for the long-term viability of mining operations.

Lastly, Long-term planning is a cornerstone for mining operations. Considering the broader implications of Bitcoin halving, miners should formulate sustainable business models that account for future reductions in block rewards. This may involve creating reserve funds, developing contingency plans, and establishing partnerships to weather potential downturns in the mining landscape.

What Is The Future Of Bitcoin Halving

The future of Bitcoin halving is marked by fascinating possibilities and challenges. The event's impact on scarcity dynamics, coupled with growing institutional involvement, is poised to shape a more mature and stable market. Anticipated technological advancements, regulatory developments, and Bitcoin's evolving role as a store of value add further layers to its future narrative. As global economic trends influence its course, Bitcoin's position in diversified investment portfolios may strengthen. Despite uncertainties, the cyclical nature of halving events promises ongoing fascination for the cryptocurrency community and the broader financial landscape.

In Conclusion

Bitcoin halving's impact on mining is complex, demanding miners' adaptability amid reduced rewards. Overcoming post-halving challenges necessitates strategic solutions like tech upgrades, revenue diversification, and environmental sustainability. Looking ahead, Bitcoin's future post-halving promises both opportunities and challenges, with scarcity dynamics, institutional involvement, and regulatory shifts shaping its course. Staying informed is crucial for navigating this evolving landscape.

Share

Share

Like

Like

Dislike

Dislike