What Are Spot Limit Orders?

0xLoki

Updated at: 5 months ago

What Are Spot Limit Orders?

Limit orders are an essential tool in Spot Trading that allow traders to set specific price points at which they are willing to buy or sell a cryptocurrency. Unlike market orders that execute instantly at current market prices, limit orders are executed only when the market reaches the predetermined price. This feature provides greater control and precision.

How Do Limit Orders Work?

When placing a limit order, the trader specifies:

-

Price Limit: The maximum price they are willing to pay when buying or the minimum price they are willing to accept when selling.

-

Order Size: The amount of cryptocurrency they intend to trade.

The order remains open until the market price matches the specified price or until the trader cancels it. If the market price does not reach the limit price, the order will not execute.

Types of Limit Orders

-

Buy Limit Orders: Placed below the current market price to purchase an asset when it dips.

-

Sell Limit Orders: Set above the current market price to sell an asset when its value rises.

Significance of Limit Orders

-

Price Control: Traders can avoid unfavorable prices, ensuring trades align with their strategy.

-

Risk Management: By setting specific entry and exit points, traders can minimize losses.

-

Efficient Trading: Allows traders to execute strategies without constant market monitoring.

-

Liquidity Contribution: Limit orders add depth to the market, benefiting the trading ecosystem.

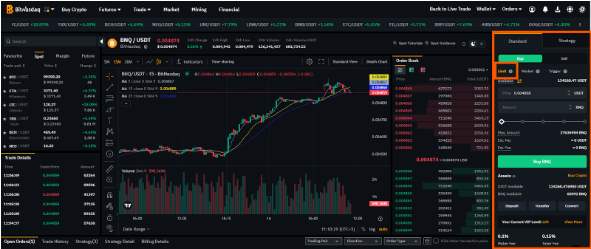

Limit orders in Spot Trading offer traders precision, control, and strategic advantages. By using this tool, traders can optimize their trading outcomes while mitigating risks. At BitNasdaq, our advanced trading platform empowers users to place limit orders for a good trading experience.