What Are Spot Market Orders?

青蛙也会飞

Updated at: 5 months ago

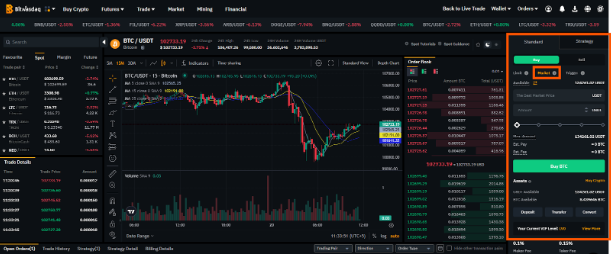

What Are Spot Market Orders?

A Spot Market order is a type of transaction on a cryptocurrency exchange, where the purchase or sale of an asset occurs immediately at the current market price. This is different from other orders like limit orders, where the transaction is only executed when the price reaches a specified level. Spot Market orders are executed in real-time, providing instant ownership of the asset.

How Spot Market Orders Work

When a trader places a Spot Market order, they are agreeing to buy or sell at the best available price. The order is matched instantly with a corresponding buy or sell order already placed on the exchange. The transaction happens without delay, ensuring that the trader gains or sells the asset quickly.

Spot Market orders are typically used by traders looking to make immediate trades, often in reaction to fast-moving market conditions. For example, if the price of Bitcoin rises rapidly, a trader may place a Spot Market buy order to take advantage of the price increase.

The Significance of Spot Market Orders

Spot Market orders hold considerable importance in the world of cryptocurrency trading. One of their key benefits is the speed at which the transaction is completed. Traders can quickly react to market movements, enabling them to capitalize on opportunities as they arise.

Another significant aspect is transparency. The Spot Market offers a real-time, transparent view of prices, which helps traders make informed decisions. Additionally, since the transaction is immediate, traders avoid the uncertainty of waiting for the order to be fulfilled, ensuring that they don’t miss out on favorable conditions.

Spot Market orders play a crucial role in crypto trading, providing instant execution and facilitating quick responses to market fluctuations.